Recent News & Blog / Business Tax

Taking your spouse on a business trip? Can you write off the costs?

If you own a business, you may wonder if you can deduct the costs of having your spouse accompany you on business trips. If your spouse isn’t an employee, you can still deduct the costs of driving your own car or renting one to reach your destination. Contact the CPAs and business tax advisors at SEK for more questions and tips to get the most out of your tax return.

What’s the best accounting method route for business tax purposes?

Businesses basically have two accounting methods to figure their taxable income: cash and accrual. The cash method often provides significant tax benefits for eligible businesses, though some may be better off using the accrual method. Contact the CPAs and business tax advisors at SEK to learn more about your small business tax.

9 tax considerations if you’re starting a business as a sole proprietor

When launching a business, many entrepreneurs start out as sole proprietors. If you’re launching a venture as a sole proprietorship, you need to understand the tax issues involved. You must pay self-employment taxes and make estimated tax payments on income earned. Contact the CPA's and business tax advisors at SEK if you want more information about the tax implications of running your business.

Update on IRS efforts to combat questionable Employee Retention Tax Credit claims

The Employee Retention Tax Credit (ERTC) provided cash that helped struggling businesses retain employees during the pandemic in 2020 and 2021. The IRS reports that it has received a deluge of “questionable” ERTC claims on amended tax returns. The IRS has now created a Voluntary Disclosure Program that allows businesses to pay back money they received after filing erroneous claims. Contact the CPA's and business tax advisors at SEK for help and to answer your tax questions.

Should your business offer the new emergency savings accounts to employees?

As part of the SECURE 2.0 law, there’s a new benefit option for employees facing emergencies. It’s called a pension-linked emergency savings account (PLESA) and it became effective for plan years beginning Jan. 1, 2024. Employers with 401(k), 403(b) and 457(b) plans can opt to offer PLESAs to non-highly compensated employees. Contact the CPA's and business tax advisors at SEK for more information and to answer your tax questions.

Maryland bFile and Maryland Tax Connect

Per communication on January 19, 2024, from the Comptroller of Maryland's office in regards to bFile and Maryland Tax Connect: January 18, 2024 - Last day to submit new Admissions and Amusement returns or make payments using the bFile system.

Tax-favored Qualified Small Business Corporation status could help you thrive

Operating your small business as a Qualified Small Business Corporation (QSBC) could be a tax-wise idea. QSBCs are the same as C corporations for tax and legal purposes, except shareholders are potentially eligible to exclude from federal income tax. However, you must meet several requirements set forth in the Internal Revenue Code. Consult with the CPA's and business tax advisors at SEK if you’re interested in operating your business as a QSBC or for more tax questions and tax tips.

Does your business have employees who get tips? You may qualify for a tax credit

If you’re an employer with a business where tipping is routine when providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. The credit is claimed as part of the general business credit. Contact the CPA's and business tax advisors for questions about this potentially valuable tax break, tax news and more tax tips!

Defer tax with a like-kind exchange

If you’re interested in selling commercial or investment real estate that has appreciated significantly, one way to defer a tax bill on the gain is with a Section 1031 “like-kind” exchange. With this transaction, you exchange the property rather than sell it. Like-kind exchanges can be an attractive tax-deferred way to dispose of real property if you anticipate a large tax bill and meet the requirements. Contact the CPA's and business tax advisors at SEK if you have tax questions or for more tax tips.

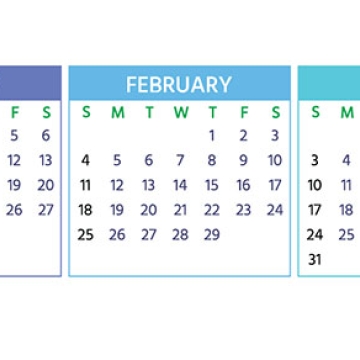

2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses during the first quarter of 2024. Contact the CPA's and financial advisors at SEK to learn more about filing requirements and ensure you’re meeting all applicable deadlines.