Making your return to in-person fundraising successful

It’s been a long two years. But many not-for-profits are starting to plan in-person galas and other special events for this coming summer and autumn.

Tax considerations when adding a new partner at your business

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it.

Opening up to SLAT opportunities

Estate tax planning can become complicated when multiple parties are involved. For example, you may be concerned about providing assets to a surviving spouse of a second marriage, while also providing for your children from your first marriage.

Need extra hands? Try local companies

If your not-for-profit is trying to fulfill its mission with less volunteer help these days, you’re not alone. A December 2021 Gallop poll found that although donating to charity has largely returned to pre-pandemic levels, volunteering was still down.

Tax issues to assess when converting from a C corporation to an S corporation

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances.

Time to spring clean your programming lineup

Does your not-for-profit offer programs that may have started out promising, but have become disappointing? Do you have replacement programs in mind but haven’t yet secured funding for them? Consider subjecting your programming lineup to a good spring cleaning.

Classify your nonprofit’s workers correctly — or risk repercussions

Many not-for-profits are understaffed in 2022, thanks to a labor shortage and pandemic-related budget shortfalls. Some organizations are filling the gaps with freelancers and contractors.

Getting started with reports in QuickBooks Online

You should be running reports in QuickBooks Online on a weekly—if not daily—basis. Here’s what you need to know.

Timing counts: Reporting subsequent events

Major events or transactions — such as a natural disaster, a cyberattack, a regulatory change or the loss of a large business contract — may happen after the reporting period ends but before financial statements are finalized.

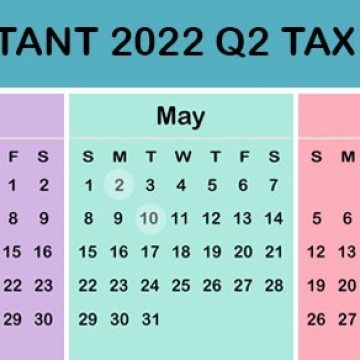

2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you.