The tax implications if your business engages in environmental cleanup

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses.

Managing company credit cards in QuickBooks

QuickBooks provides an efficient and effective way to manage and reconcile your business credit cards. There are different ways to record your credit card transactions however the method outlined is preferred and will help to:

Close-up on pushdown accounting for M&As

Change-in-control events — like merger and acquisition (M&A) transactions — don’t happen every day. If you’re currently in the market to merge with or buy a business, you might not be aware of updated financial reporting guidance that took effect in November 2014.

Flex plan: In an unpredictable estate planning environment, flexibility is key

The Tax Cuts and Jobs Act (TCJA) made only one change to the federal gift and estate tax regime, but it was a big one. It more than doubled the combined gift and estate tax exemption, as well as the generation-skipping transfer (GST) tax exemption. This change is only temporary, however.

Accounting for contributions and grants is now easier

Accounting for contributions and grants has often proven complicated for not-for-profits, especially when they come with donor-imposed conditions. But 2018 guidance from the Financial Accounting Standards Board (FASB) provided some much-needed clarification of earlier instructions.

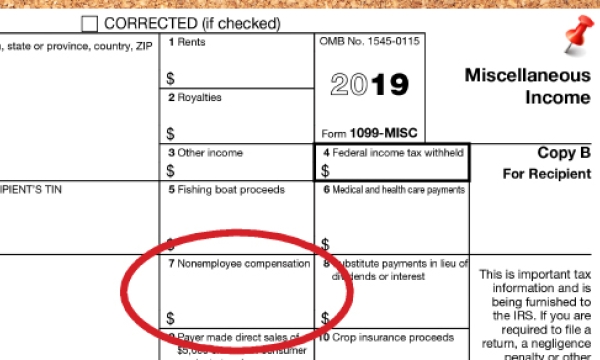

Small businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay non-employee compensation, as well as file copies with the IRS.

GAAP vs. tax-basis: Which is right for your business?

Most businesses report financial performance using U.S. Generally Accepted Accounting Principles (GAAP). But the income-tax-basis format can save time and money for some private companies.

How the EU’s data protection regulations might affect U.S. nonprofits

Your not-for-profit may have paid little attention to the European Union’s (EU’s) General Data Protection Regulation (GDPR), which took effect May 25, 2018. The GDPR revises standards for privacy rights, information security and compliance in the EU.

Setting Up Sales Taxes in QuickBooks, Part 2

Now that you have your sales taxes set up, you’ll be able to use them in transactions and reports.

Depreciation and Cost Recovery Rules: 2019 and Later

The Tax Cuts and Jobs Act of 2017 (TCJA) brought with it some changes and updates to Depreciation rules. SEK’s tax department has created this one page quick reference guide to help answer some of the most common Depreciation questions we receive.